colorado estate tax exemption 2021

The state is required to reimburse local governments for the lost revenue as a result of the increased exemption. However as the exemption increases the minimum tax rate also increases.

Still Working Remotely Your 2021 Taxes May Be More Complicated

The states exclusion amount is.

. Connecticut continues to phase in an increase to its estate exemption planning to match the federal exemption by 2023. C Suite 113 Denver CO. Yes real estate tax and property tax are considered the same.

On June 18 2019 Vermont enacted H. Previously the exemption was close to 58 million matching the pre-TCJA federal level and adjusted for inflation While the exemption has been reduced the rates have also dropped. At the library school computer lab shared work computer etc.

Colorado Property TaxRentHeat Rebate Program. Tax rates can be above and below these numbers. Extended this exemption to the surviving spouse of a disabled veteran who previously received the exemption.

Forms published in 2021 onward are fillable and savable except the instruction booklets. DR 1079 - Payment of Withholding Tax on Certain Colorado Real Property Interest Transfers. Applications are available from the Colorado Department of Military and Veterans Affairs at 1355 S.

Vermonts estate tax is a flat rate of 16 on the portion of a taxable estate that exceeds the exclusion amount. Connecticuts estate tax will have a flat rate of 12 percent by 2023. The Colorado Homestead Exemption allows one to exempt up to 75000 of their real property value when filing bankruptcy.

Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service-connected permanent and total disability is exempt from taxation of the veteran is a permanent resident of Florida and has legal title to the property on January 1 of the tax year for which exemption is being claimed. Alaska Disabled veterans in Alaska may receive property tax exemptions up to the first 150000 of the assessed value of hisher primary residence if the veteran is. The Deadline to apply for tax year 2022 payable in 2023 is July 15th.

Tax is tied to federal state death tax credit. Colorado exempts from the states sales and use tax all sales storage and use of components used in the production of alternating current electricity from a renewable energy source. 541 which increased the Vermont estate tax exemption to 4250000 in 2020 and 5000000 in 2021 and thereafter.

1 2021 and Jan. DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest. The estate tax rates in Connecticut are the lowest starting at 780 and rises to 12.

Groceries and prescription drugs are exempt from the Colorado sales tax. How to qualify for a senior tax exemption. The exemption continued to increase annually until it matched the federal estate tax exemption in 2019.

Colorado collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The exemption is adjusted for inflation thereafter. Benefits of qualifying for an over 65 property tax exemption.

DR 5782 - Electronic Funds Transfer. Colorado lawmakers finished a significant rewrite of the states tax code on Wednesday when Gov. The State of Colorados Division of Local Affairs DLG-57 form is part of the information sent to each Tax Entity to meet this obligation.

DR 5714 - Request for Copy of Tax Returns. 2021 Final Certification of Value 2021 Initial Preliminary Certification of Value. As per this exemption the taxing units have the option to offer an extra homestead exemption of at least 3000 for those aged 65 or older.

Estate tax rates are typically assessed in brackets after the exemption threshold like income tax is assessed. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Chapter 7 bankruptcy is typically applied to lower income individuals and involves liquidating your assets to pay off your debt.

DR 1778 - E-Filer Attachment Form. Seniors age 65 and over and disabled persons are eligible for a Colorado property taxrentheat rebate if their income is less than. Connecticut has no inheritance tax but does levy an estate tax and a gift tax.

Connecticut taxes the value of an estate over 51 million. Do not save completed tax forms on a public device eg. The application deadline for the Senior Exemption is July 15.

Unlike the Federal Income Tax Colorados state income tax does not provide couples filing jointly with expanded income tax brackets. For those who qualify for the over 65 exemption there is something called the property tax ceiling. Colorados maximum marginal income tax rate is the 1st highest in the United States ranking directly below Colorados.

The tax also applies to nonresidents who owned real or tangible personal property in Connecticut. Remedies for Recipients of Notice of Forfeiture of Right to Claim Exemption Instructions and FAQs Annual Reports for Exempt Property Schools Charitable 2022 FraternalVeterans Organizations 2022 Religious Purposes 2021 Religious Purposes 2022 Exempt Property Report Online Filing. Vermont does not permit portability of its estate tax exemption.

DR 1830 - Material Advisor Disclosure Statement for Colorado Listed Transaction. The estate tax rate starts at 10 on the first 1 million then 100000 plus 104 on the next million. Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10.

The H-2 property tax exemption if you qualify will offer a full exemption from state property taxes and reduce a propertys value by 5000 on all property and school districts. The tax rate as of 2019 typically starts at 10 and then increases in steps up to about 16. There are two main types of bankruptcy for individuals.

The Act increases the exemption for business personal property tax from 7700 to 50000 for tax years beginning Jan. Make sure you protect your personally identifiable information PII. The Internal Revenue Service.

In 2020 the rates ranged from 12 to 16 percent but they now range from 112 to 16. Refund Mechanisms Used for TABOR Surpluses Tax Years 1997 through 2019. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

No refunds were required for unlisted years including 1993 through 1996 and 2020. Colorado has 560 special sales tax jurisdictions with local sales taxes in. The Colorado General Assembly has reinstated funding for the Senior Property Tax Exemption aka Senior Homestead Exemption for tax year 2021 payable in 2022.

Oregon Oregons estate tax rates changed on January 1 2012 so that estates valued between 1 million and 2 million would pay slightly less in estate taxes and estates valued over 2 million would pay more. Jared Polis signed two new laws. Arizona for example provides a sales tax exemption for the retail sale of solar energy devices and for the installation of solar energy devices by contractors.

The Districts estate tax exemption has dropped to 4 million for 2021. No separate state QTIP election permitted.

How To Avoid A Tax Bomb When Selling Your Home

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

States With An Inheritance Tax Recently Updated For 2020

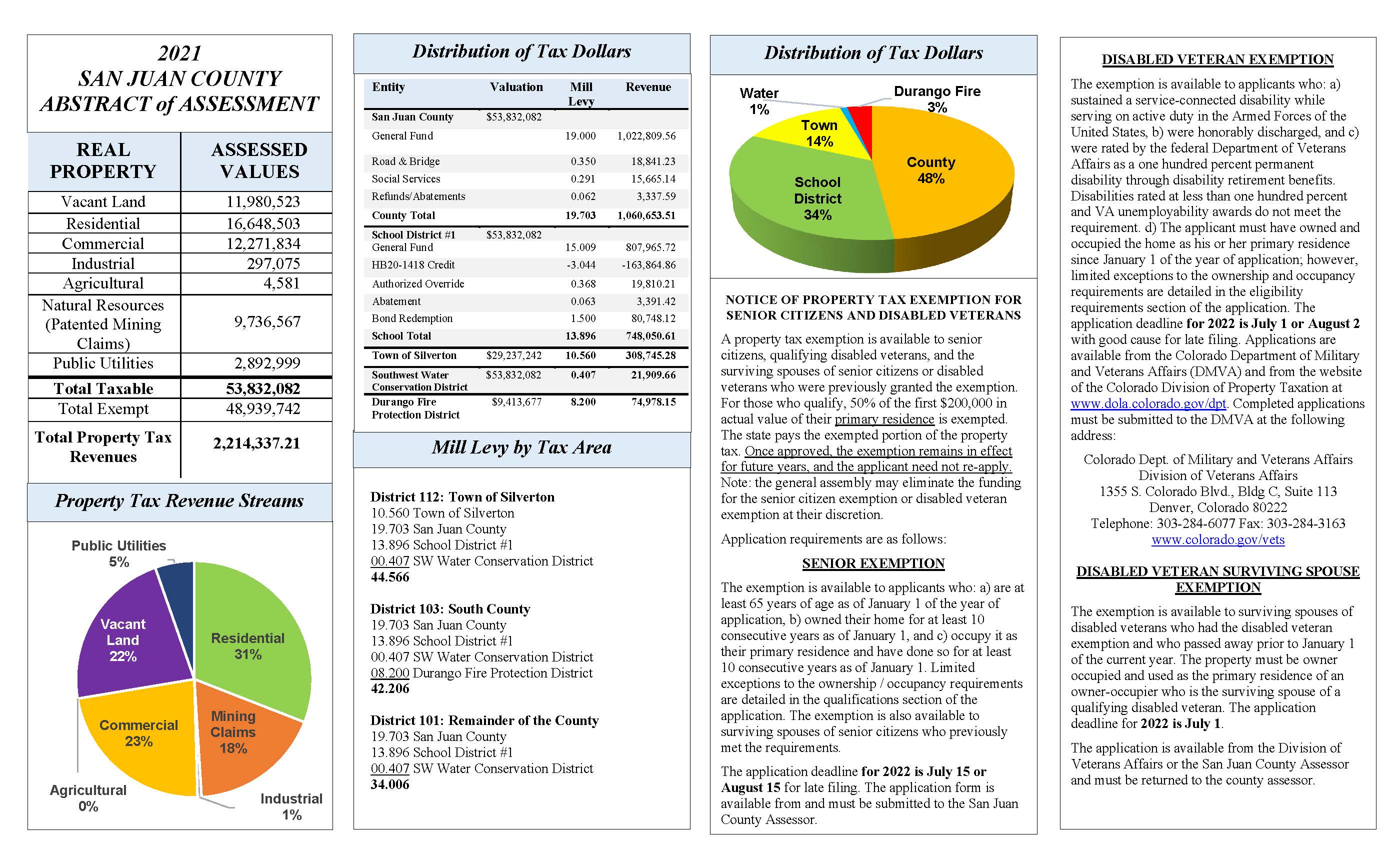

Calculating Property Taxes San Juan County

2021 Capital Gains Tax Rates By State Smartasset

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Calculating Property Taxes San Juan County

Vancouver Real Estate Newsroom Vancouver Real Estate Podcast

Vancouver Real Estate Newsroom Vancouver Real Estate Podcast

Vancouver Real Estate Newsroom Vancouver Real Estate Podcast

How Anyone Can Get A 2021 Tax Deduction Charitable Donations

Colorado Initiative To Reduce Property Tax Assessment Rates And Allow The State To Retain 25 Million In Revenue Above The State S Tabor Spending Cap For Five Years Qualifies For 2021 Ballot Ballotpedia News

2021 Us Foreign Earned Income Exclusion The Ultimate Guide Nomad Capitalist

Should You Move Or Just Improve This Will Help You Decide How To Spend Your Money Move Home Improvement Loans Best Places To Live Beautiful Places To Live